Digital Finance For Women-led MSMEs

Enhancing women's financial inclusion through Digital Financial Services in Kenya

Year: 2024

Location: Kenya

Partners: M-KOPA

Role: Design Director

Approach: HCD Research, Qualitative Research, Behavioural Design, Persona mapping

Team: Charity Mbaka, Duncan Aidoh Adera, Maria Alejandra Sandoval, Ravi Chhatpar

Context

M-KOPA is a digital fintech company that offers low-cost digital products and services through a credit "pay-as-you-go" model. They sought to improve their DFS offerings for low-income women entrepreneurs, specifically owners of micro, small and medium enterprises (MSMEs) in Kenya, to enable them to grow and sustain their businesses. This work used a Human-Centred Design (HCD) approach that incorporated qualitative, ethnographic, and behavioural design tools and methods to generate deep insights about the needs, motivations and barriers that influence women-owned MSMEs' digital financial behaviour.

Takeaways

1. Digital microloans serve as a critical lifeline for many women entrepreneurs, yet they are frequently diverted to meet immediate household needs rather than business scaling. This shift often traps women in a persistent loop of debt, which results in negative perceptions of credit. To be effective, product design must move beyond the transaction to address these underlying behavioural shifts and mental models around credit and borrowing.

2. For micro-entrepreneurs, cash remains king due to the high costs of digital transactions. However, as businesses scale, the need for rigorous bookkeeping and security makes digital finance essential. The design challenge lies in navigating these shifting needs—creating tools that balance the immediate 'ease of cash' with the long-term 'necessity of digital' as an enterprise grows.

Research Objectives

Building on M-KOPA’s existing product offering, this initiative sought to expand the value proposition for underbanked consumers by developing a more robust suite of financial services. Our mission was:

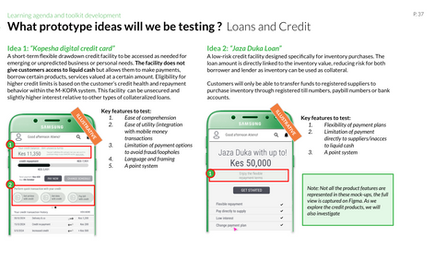

1. To design and validate effective credit, insurance and integrated wallet features attuned to M-KOPA’s customers' needs and desires.

2. To conduct high-level scoping of different loan structures, insurance, and other integrated product offerings for different persona archetypes, which will inform the future product offerings once M-KOPA has the necessary visibility of financial health data.

Creative Exploration

We spoke to 96 women business owners within diverse age groups, and dealing in a variety of retail activities (clothes, food, beauty products) and services (beauty, food, online, and others).

The research toolkit used an exhaustive suite of participatory activities, including interactive journey mapping to trace the evolution of women-led businesses—documenting where they started, their current operations, and their future aspirations. We also do ecosystem mapping exercises and live prototyping to test low- and medium-fidelity features, building directly onto M-KOPA’s existing product base to "design as we go" in response to real-time feedback and allow women to digitally navigate the prototypes and share feedback. To capture the granular details of their daily lives, the methodology involved deep contextual immersion through group sessions and on-site observations within the business environment. This allowed us to experience the nuanced rhythms of how these women run their enterprises and spend their days.

Highlights

Women-owned MSMEs are continuously evolving and adapting their financial strategies to navigate their ever-changing circumstances, transitioning from uncertainty to confidence as their businesses grow. Most reinvest their profits back into their businesses, while some diversify their investments through groups to share investment risk.

Women-owned MSMEs rely on informal credit for business expansion, and often turn to formal lenders for emergencies. This cycle can exacerbate financial vulnerability and increase the debt burden.

Even with high digital and mobile phone penetration, MSME owners prefer cash over mobile payments due to high transaction costs. However, as businesses expand, mobile money payments become essential for business tracking and record-keeping.

Outcomes

We surfaced four distinct MSME personas and four MVP (Minimum Viable Product) options that represent a diverse range of female business owners, each facing unique challenges and opportunities on their business journey. By understanding their behaviours, needs, and goals, variables that can support the development of tailored DFS that better address their circumstances and foster sustainable business growth.

Scroll through the gallery before to view snapshots of the assets that we developed for this work.

"

"I know the business won’t pick up immediately, but the loan will buy me some time to make more stock and serve more customers eventually.”

Quote from a food vendor in Eldoret, speaking about how micro-loans help stabilize her business.